state farm no-fault auto insurance

State Farm No-Fault Auto Insurance: Navigating Coverage and Benefits

Source www.ramseysolutions.com

Introduction

Hey there, readers! Welcome to our comprehensive guide to State Farm's no-fault auto insurance. In this article, we'll be exploring the ins and outs of this coverage, including its benefits, coverage options, and everything you need to know to make an informed decision. So, buckle up and let's dive into the world of State Farm no-fault auto insurance!

Understanding No-Fault Auto Insurance

What is No-Fault Auto Insurance?

State Farm's no-fault auto insurance follows the concept of "no-fault," meaning that each driver's insurance covers their own injuries and damages, regardless of who is at fault in an accident. This system differs from traditional fault-based insurance where the at-fault driver's insurance pays for the damages.

Benefits of No-Fault Auto Insurance

No-fault auto insurance offers several advantages over fault-based systems:

- Quicker Claim Processing: Claims can be processed more efficiently since there's no need to determine fault.

- Reduced Legal Costs: No-fault insurance eliminates the need for lengthy and expensive legal battles.

- Coverage for All Drivers: Regardless of who is behind the wheel, no-fault insurance provides coverage for injuries sustained in an accident.

State Farm's No-Fault Auto Insurance Coverage

Personal Injury Protection (PIP)

PIP coverage covers medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault. State Farm's PIP coverage typically includes:

- Hospital and doctor visits

- Pain management

- Physical therapy

- Lost income

Supplemental Uninsured/Underinsured Motorist (SUM/UIM)

SUM/UIM coverage protects you if you're injured by a driver who doesn't have enough or any insurance. This coverage can provide compensation for medical expenses, lost wages, and pain and suffering.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it's damaged in an accident, regardless of fault. State Farm's collision coverage can include:

- Damage from crashes

- Damage from rolling over

- Damage from falling objects

Comprehensive Coverage

Comprehensive coverage provides protection for your vehicle from events other than collisions, such as:

- Theft

- Vandalism

- Fire

- Natural disasters

Differences Between No-Fault and Fault-Based Auto Insurance

Key Differences

| Feature | No-Fault Insurance | Fault-Based Insurance |

|---|---|---|

| Fault Determination | Not applicable | Necessary |

| Claim Processing | Faster | Can be slower |

| Legal Costs | Reduced | Can be significant |

| Coverage | Covers all drivers | Only covers at-fault driver |

When to Consider Each Type

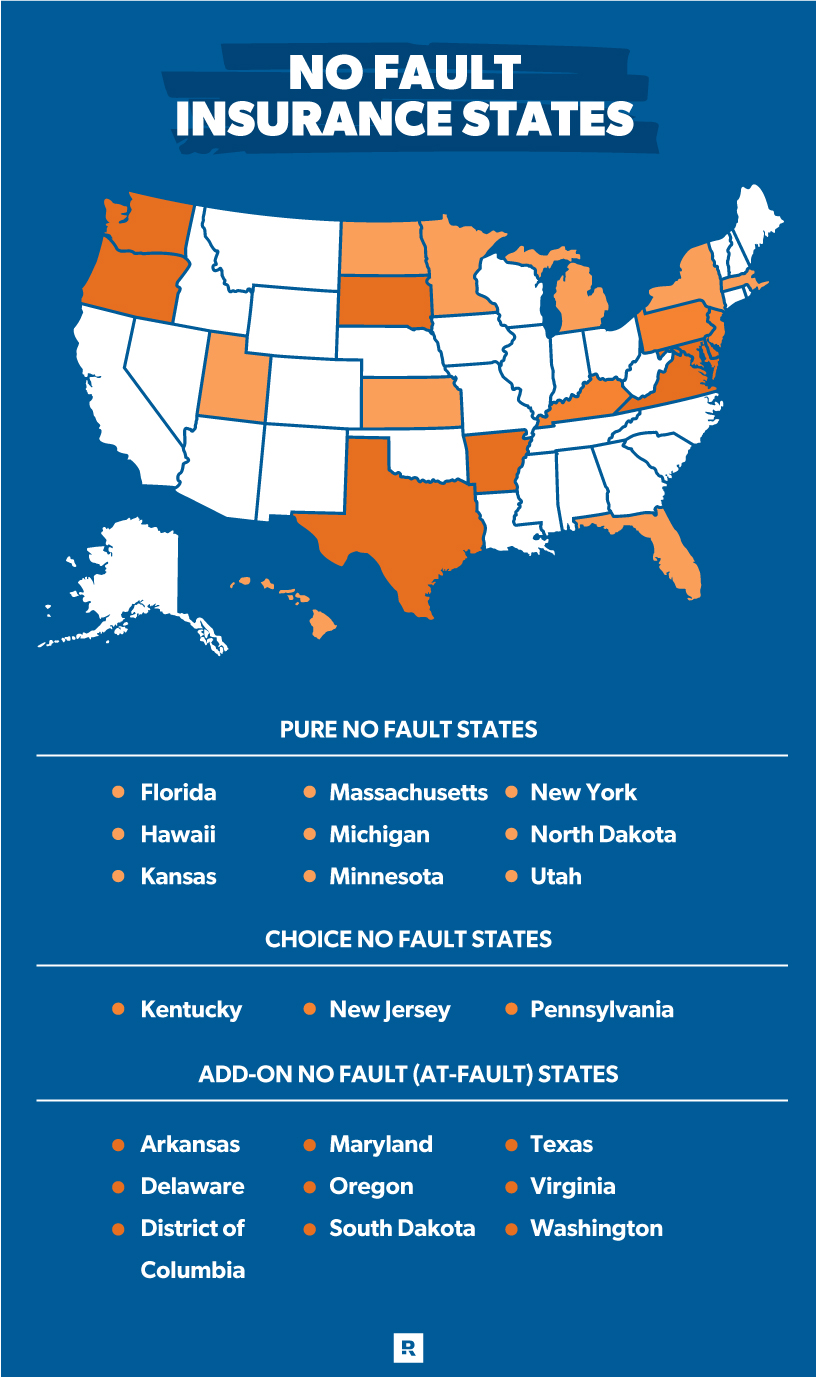

No-fault auto insurance is ideal if you live in a state that has adopted the no-fault system. Fault-based insurance may be more suitable if you live in a state where fault is a significant factor in determining insurance coverage.

Table of State Farm No-Fault Auto Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Personal Injury Protection (PIP) | Covers medical expenses and other costs related to injuries |

| Supplemental Uninsured/Underinsured Motorist (SUM/UIM) | Protects you from uninsured or underinsured drivers |

| Collision Coverage | Pays for repairs or replacement of your vehicle after a crash |

| Comprehensive Coverage | Covers your vehicle from events other than collisions |

| Bodily Injury Liability Coverage | Covers injuries to others caused by you in an accident |

| Property Damage Liability Coverage | Covers property damage caused by you in an accident |

Conclusion

State Farm's no-fault auto insurance provides a comprehensive range of coverage options to protect you and your finances in case of an accident. By understanding the benefits, coverage options, and differences between no-fault and fault-based insurance, you can make an informed decision to ensure you have the appropriate coverage for your needs. Be sure to check out our other articles for more information on auto insurance and other important financial topics. Thanks for reading!

FAQ about State Farm No-Fault Auto Insurance

What is no-fault auto insurance?

Answer: No-fault auto insurance covers medical expenses and lost wages for drivers and passengers involved in an accident, regardless of who is at fault.

How does State Farm no-fault auto insurance work?

Answer: In states with no-fault laws, State Farm's coverage pays for eligible expenses after an accident, subject to policy limits and coverage selections.

What are the advantages of getting no-fault auto insurance from State Farm?

Answer: Prompt claims assistance, wide network of healthcare providers, and peace of mind knowing you're protected.

Who can get State Farm no-fault auto insurance?

Answer: Drivers who live in states with no-fault laws, such as Michigan, Pennsylvania, and New York.

What does no-fault auto insurance cover?

Answer: Typically, medical expenses, lost wages, and essential services like transportation and household assistance.

How much does no-fault auto insurance cost?

Answer: Premiums vary based on factors like age, driving history, and vehicle type. Contact State Farm for a personalized quote.

What are the benefits of choosing State Farm for no-fault auto insurance?

Answer: Excellent customer service, financial strength, and a dedicated team of insurance professionals.

How can I get a quote for State Farm no-fault auto insurance?

Answer: Call your local State Farm agent or visit their website.

What should I do if I get into an accident and have no-fault auto insurance?

Answer: Contact State Farm immediately to report the accident and file a claim.

Is no-fault auto insurance required in every state?

Answer: No, it's only required in states that have adopted no-fault laws.

Post a Comment for "state farm no-fault auto insurance"