state farm underinsured motorist coverage

Source www.autoinsurance.org

Underinsured Motorist Coverage: What It Is

Underinsured motorist coverage (UIM) is an essential add-on to auto insurance that protects you and your family from drivers with insufficient liability coverage. If you're involved in an accident caused by an at-fault driver who does not have enough insurance to cover your damages, UIM steps in to make up the difference.

Why You Need UIM Coverage

In today's fast-paced world, where reckless driving and distracted drivers are prevalent, the chances of encountering an underinsured motorist are higher than ever. Without UIM coverage, you could be left facing hefty medical bills, lost wages, and other expenses that exceed the at-fault driver's liability limits. UIM provides peace of mind, ensuring that you're financially protected even when others fall short on responsibility.

Selecting the Right Coverage Limits

The key to effective UIM coverage lies in choosing appropriate coverage limits. These limits should align with your financial assets and the potential costs associated with injuries and damages. Consider your medical expenses, lost income, and future earning capacity when determining your UIM coverage needs. State Farm offers flexible coverage limits, allowing you to customize your protection based on your individual circumstances.

UIM Coverage: Beyond Basics

Lost Wages and Earning Capacity: UIM coverage goes beyond medical bills to compensate you for lost wages and the potential loss of future earning capacity due to injuries sustained in an accident.

Pain and Suffering: In some states, UIM coverage extends to providing compensation for pain and suffering, mental anguish, and other non-economic damages endured as a result of the accident.

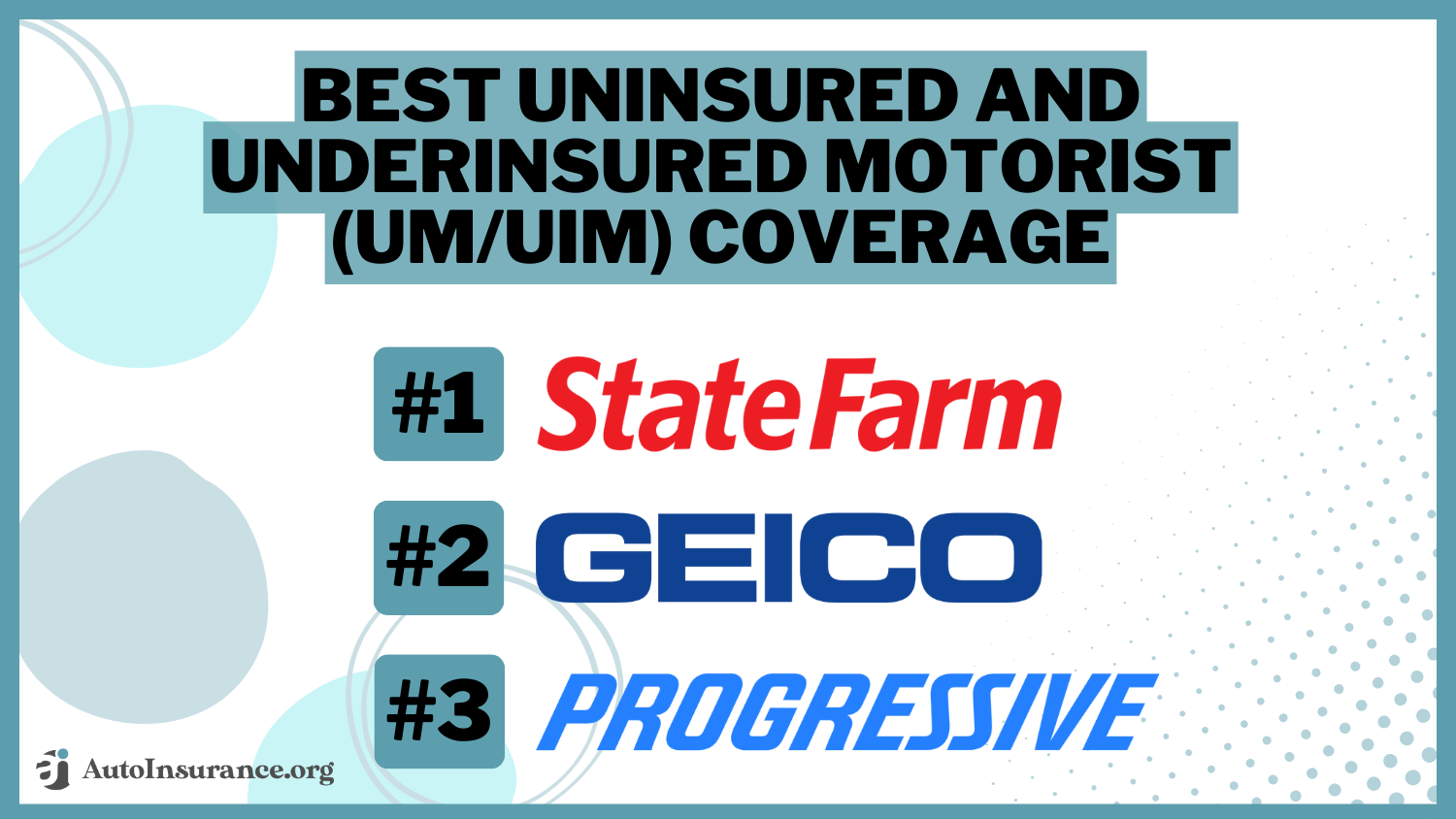

Comparing State Farm UIM Coverage

Extensive Network: State Farm boasts an extensive network of experienced agents who can guide you through the complexities of UIM coverage and provide tailored recommendations based on your specific needs.

Nationwide Coverage: Your State Farm UIM coverage is valid throughout the United States, ensuring protection regardless of where you travel.

Financial Strength: State Farm's financial stability and long-standing reputation as a reliable insurance provider give you peace of mind that your claims will be handled fairly and efficiently.

Table: Benefits of State Farm Underinsured Motorist Coverage

| Benefit | Explanation |

|---|---|

| Financial Protection | Covers expenses and losses beyond the at-fault driver's liability limits |

| Lost Wages Replacement | Compensates for lost income and diminished earning capacity |

| Non-Economic Damages | May provide coverage for pain and suffering, emotional distress, and other non-financial losses |

| Nationwide Coverage | Protection extends across the United States |

| Experienced Agents | Access to knowledgeable agents for personalized guidance and support |

| Financial Stability | Assured claims handling by a financially sound insurance provider |

Conclusion: Protect Yourself and Your Loved Ones

Don't leave your financial security vulnerable to the actions of underinsured drivers. State Farm's underinsured motorist coverage offers a comprehensive shield against inadequate liability insurance, giving you peace of mind and ensuring that you're fully protected in the event of an accident.

For more insightful articles on auto insurance and financial protection, explore our blog today.

FAQ about State Farm Underinsured Motorist Coverage

What is underinsured motorist coverage?

It provides financial protection when you're injured in an accident caused by a driver who doesn't have enough insurance to cover your expenses.

How much coverage do I need?

It's recommended to have UM coverage equal to the amount of bodily injury liability coverage you carry on your own policy.

What does UM coverage cover?

It covers medical expenses, lost wages, pain and suffering, and other damages resulting from the accident.

Who is covered under my policy?

UM coverage typically extends to you, your family members, and anyone else occupying your insured vehicle.

How does UM coverage work?

If the at-fault driver's insurance doesn't fully compensate you, UM coverage will pay the difference up to your policy limits.

What are the benefits of having UM coverage?

It provides peace of mind, protects you from financial hardship, and ensures you have access to adequate compensation after an accident.

How much does UM coverage cost?

The cost varies depending on your policy and coverages. Contact your State Farm agent for an estimate.

When should I file a UM claim?

File a claim as soon as possible after the accident. State Farm has a 24/7 claims hotline to assist you.

What documentation do I need to file a UM claim?

Gather evidence such as the accident report, medical records, and insurance information for both drivers.

What can I expect during the claims process?

State Farm will investigate the accident, review your documentation, and determine the amount of coverage available to you. The process may take time, but State Farm will keep you informed every step of the way.

Post a Comment for "state farm underinsured motorist coverage"