State Farm auto insurance deductible

The Essence of State Farm Auto Insurance Deductibles: An Exhaustive Guide

Source www.thetechedvocate.org

Greetings, readers! Embark on an in-depth exploration of State Farm's auto insurance deductible, a crucial aspect of safeguarding your financial well-being. Buckle up as we unravel its complexities, empowering you to make informed decisions that protect your assets.

Unraveling the Deductible Concept

At the core of every State Farm auto insurance policy lies the deductible, a predetermined amount you're responsible for paying out-of-pocket in the event of an accident. It's the shared responsibility between you and State Farm in covering repair or replacement costs. Choosing an appropriate deductible is key to striking a balance between affordability and adequate coverage.

Tailoring Your Deductible: Pros and Cons

Low Deductibles:

- Pros: Minimize out-of-pocket expenses in minor accidents.

- Cons: Higher premiums, as State Farm assumes greater financial risk.

High Deductibles:

- Pros: Lower premiums, offering significant savings.

- Cons: Larger financial burden in the event of an accident.

Deductible Options at State Farm

State Farm offers a range of deductible options to suit individual needs and budgets:

- $250

- $500

- $750

- $1,000

- $1,500

- $2,000

The Complicated Case of Collision and Comprehensive Deductibles

State Farm auto insurance policies typically include separate deductibles for collision and comprehensive coverage.

- Collision: Covers damages caused by impact with another vehicle or object.

- Comprehensive: Covers non-collision damages, such as theft, vandalism, and weather events.

Deductible and Premium Relationship

As mentioned earlier, the deductible you choose directly impacts your insurance premiums. Generally, a higher deductible reduces your premium, while a lower deductible increases it. Finding the optimal balance between affordability and coverage is crucial.

Deductible Changes: Know Your Options

Life circumstances can change, and so can your deductible needs. State Farm allows policyholders to adjust their deductibles, subject to certain restrictions and potential premium changes.

Deductible Table Breakdown

For your convenience, here's a table summarizing the key deductible options offered by State Farm:

| Deductible | Collision | Comprehensive |

|---|---|---|

| $250 | Available | Available |

| $500 | Available | Available |

| $750 | Available | Available |

| $1,000 | Available | Available |

| $1,500 | Available | Available |

| $2,000 | Available | Available |

Conclusion

Navigating the world of State Farm auto insurance deductibles can be daunting, but we hope this comprehensive guide has shed light on its intricacies. Understanding the concept, pros, cons, and options available will empower you to tailor your policy to your unique needs. Don't hesitate to delve into our other articles for more insightful information on various aspects of insurance, financial planning, and personal finance.

FAQ about State Farm Auto Insurance Deductible

What is a deductible?

A deductible is the amount of money you pay out of pocket before your insurance coverage kicks in.

What is my State Farm auto insurance deductible?

You can find your deductible on your policy's declaration page. It's typically expressed as a dollar amount.

How does a deductible affect my premium?

In general, the higher your deductible, the lower your premium will be.

Can I change my deductible?

Yes, you can change your deductible at any time by contacting your State Farm agent.

What happens if I have an accident and my damages are below my deductible?

If the cost of repairs is less than your deductible, you will be responsible for paying the entire amount.

What happens if I have an accident and my damages exceed my deductible?

If the cost of repairs exceeds your deductible, State Farm will cover the remaining balance up to your policy limits.

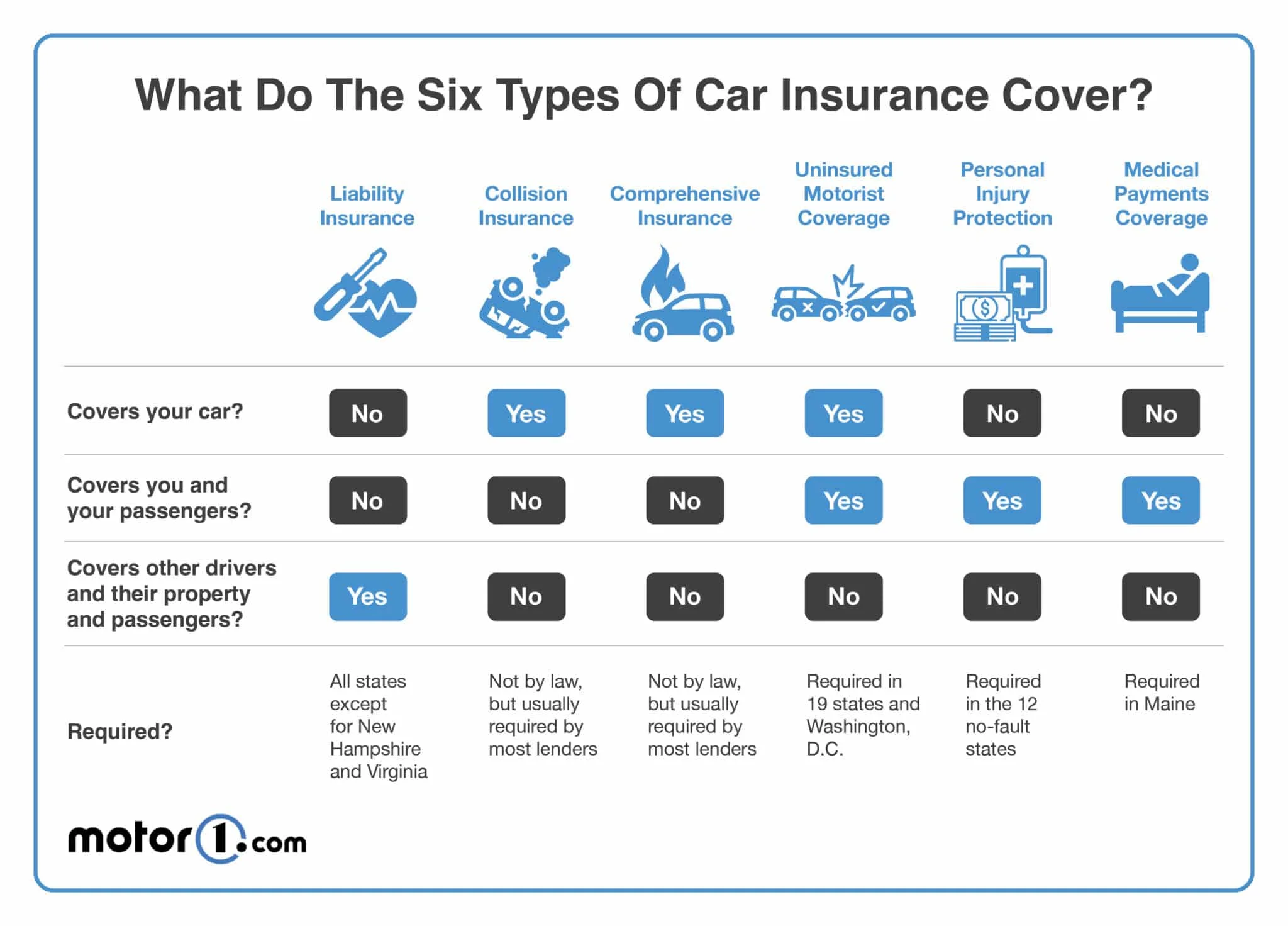

Are there different types of deductibles?

Yes, there are different types of deductibles, such as comprehensive, collision, and glass deductible.

What is a comprehensive deductible?

A comprehensive deductible applies to damages that are not caused by a collision, such as theft, vandalism, or natural disasters.

What is a collision deductible?

A collision deductible applies to damages caused by a collision with another vehicle or object.

What is a glass deductible?

A glass deductible applies to damages to your vehicle's windows or windshield.

Post a Comment for "State Farm auto insurance deductible"